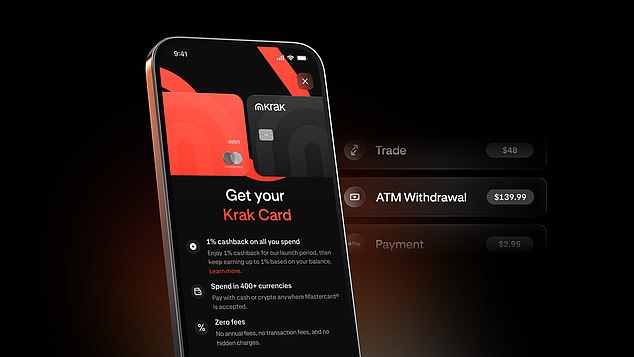

Crypto platform Kraken has today launched a new debit card account offering multi-asset transactions and cashback rewards.

The ‘Krak’ card will allow users to spend money from any assets held on their account, including cash, cryptocurrencies and international currencies.

More than 400 crypto and fiat currency options will be available to spend, Kraken said.

The platform has plans to add equities and tokenised equities as asset options from 2026.

Kraken’s global head of consumer, Mark Greenberg, said: ‘With Krak, you can now spend the assets that you hold.’

The Krak card can be used anywhere that Mastercard payments are accepted.

However, customers should know that, as it is not a bank, Kraken and Krak are not FSCS-protected.

Options: More than 400 crypto and fiat currency options will be available to spend on crypto platform Kraken’s new debit card

It does hold an Electronic Money Institution license, meaning that fiat currency assets held on Krak are backed on a one-to-one basis with reserve currency held by Kraken.

EMI licenses mean that the reserve funds must be held separate from a firm’s operating funds.

If they go bust, you may not receive all of your money, depending on the administrator or liquidator taking some for costs, and the amount held in reserve, but you should get most of your money back.

Greenberg added: ‘To us, everything is money. You should be able to use whatever assets you hold to pay for everyday goods and services in the digital era we live in.’

Users can also make purchase using a combination of all of their assets.

For example, users could make a £100 purchase using an £80 cash balance, with the remaining £20 coming from their next allocated secondary asset, such as Bitcoin, Ethereum or Solana.

Users can choose the order in which assets are spent, so that once one is used up, their next allocated asset will then be used. They can also exclude certain types of currency or crypto from spending altogether.

Kraken itself has some 15million users worldwide, and was launched to customers in 2013, making it one of the longest standing crypto platforms.

Kraken is authorised by the Financial Conduct Authority, and holds MiCAR licenses in Europe.

The card will have no foreign exchange fees on international currencies, and has no monthly fees

Spending is instant, Kraken says, with real-time currency conversion taking place at the point of payment. Kraken also offers instant asset transfers.

The card will pay users one per cent cashback on all purchases, with the reward available in either cash or Bitcoin.

Kraken says the card is a ‘modern, multi-asset alternative [to traditional banking] built for the modern digital economy.’

Kraken also plans to add salary deposits to Krak accounts, meaning that users can be paid directly into Krak.

The card will have no foreign exchange fees on international currencies, and has no monthly fees.

The card is being rolled out gradually, but will first be available to Kraken’s UK and EU customers, with other markets to follow in coming weeks.

You don’t have to own crypto to use it

Despite being a crypto platform, Greenberg said Kraken isn’t aiming to market its Krak card to crypto investors, and instead will focus on an audience that doesn’t necessarily own any crypto.

Speaking last week, Greenberg said: ‘We want to be the be the money app you use by default. Our ambition will only end when most folks are using Krak.’

The Krak platform, which was launched ahead of the debit card introduction, has some 450,000 users across 160 countries.

Krak also offers ‘vaults’, which give users access to DeFi lending, which it says can return more than 10 per cent annual percentage yield.

DeFi lending is an alternative to traditional lending, where users lend cryptocurrency via smart contracts on a blockchain, which enforce certain interest rates.

It is important to note that DeFi lending has significant risks from market volatility, uncertain regulations and of the borrower failing to repay their loan.

Kraken says lending strategies can be tailored to each customer’s risk profile.

SAVE MONEY, MAKE MONEY

4.52% cash Isa

4.52% cash Isa

Trading 212: 0.67% fixed 12-month bonus

Sipp cashback

Sipp cashback

£200 when you deposit or transfer £15,000

Top Isa without bonus

Top Isa without bonus

Straightforward 4.55% cash Isa with no boost

£100 cashback

£100 cashback

5% cashback on investments, up to £100

£20 gift card

£20 gift card

Hold £1,000 after three months in Plum’s cash Isa

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.

#Kraken #launches #debit #card #lets #spend #crypto #currencies