- Trainline upgrades earnings guidance and boosts share buybacks

- The group says European rail liberalisation is boosting competition

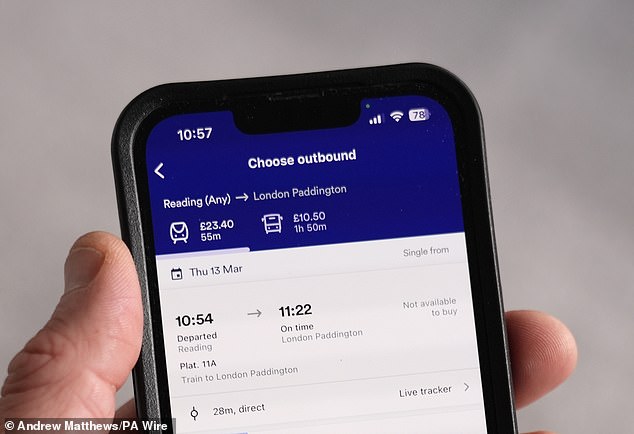

Trainline shares rose sharply on Thursday morning after the rail ticketing platform lifted annual profit expectations and extended investor payouts.

The FTSE 250 group’s chief executive Jody Ford cheered ‘rail liberalisation’ efforts in Europe as sales soared in the region over the first half of the year, while the groups business arm, Trainline Solutions, also performed well.

In the UK, consumer net ticket sales were up 8 per cent year-on-year at £2.1billion, reflecting ‘strength in leisure travel sales, commuter market recovery and the lapping of strike action in the prior year’.

Growth was achieved despite Transport for London’s ‘Project Oval’, which hampered sales as the authority expanded its contactless payment network.

But UK consumer sales were flat on the same time last year at £107million, primarily reflecting a reduction in the headline commission rate charged by Trainline in April, from 5 to 4.5 per cent.

Trainline also highlighted stronger demand in on-the-day travel, which generates relatively lower rates of revenue than longer-distance travel.

UK sales were boosted by ‘strength in leisure travel sales, commuter market recovery and the lapping of strike action in the prior year’

International consumer net ticket sales ticked 2 per cent higher to £594million as Trainline focused marketing efforts on ‘European high-speed routes with emerging carrier competition’.

This includes the French Southeast network, where Trainline’s sales soared 34 per cent.

French regions have been able to tender competitively for regional rail traffic, but this became mandatory in 2023.

Trainline says opening up the French rail market to competition has lifted its revenues in the region.

That was despite ‘changes to Google’s search results page’ Trainline says are hurting demand from US tourists.

Meanwhile, Trainline Solutions net ticket sales soared 18 per cent to £529 million.

The group also credited its operating leverage and cost cutting efforts as it told investors it now expects full-year earnings before nasties growth to come in at the high end of its 6 to 9 per cent guidance range.

Trainline told shareholders it would now follow an existing £75million share buyback programme by buying another £150million worth of shares over the next 12 months.

‘If completed in full, it would imply £350 million of shares being bought back and cancelled over a three-year period,’ it added.

Chief executive Ford said: ‘Rail liberalisation in Europe continues to demonstrate the value Trainline brings as the preeminent domestic aggregator, most recently in south east France where increased carrier competition between Paris, Lyon and Marseille has driven Q2 sales growth of 34 per cent.

‘At the same time, Trainline Solutions has become a £1 billion sales business as we help more clients of all sizes, from SMEs to the world’s largest travel management companies, ramp up business travel sales across Europe.’

Trainline shares were 9.8 per cent to 285.4p in early trading. However, they have still lost nearly a third of their value since the start of the year.

Lale Akoner, global market analyst at Etoro, said: ‘Trainline is evolving from a UK-focused ticketing platform into Europe’s default rail aggregator.

‘The combination of resilient domestic demand, expanding international opportunities, and consistent capital returns suggests the current valuation may not fully reflect the company’s scalability.

‘In short, earnings are being driven by structural growth rather than one-off factors, and that positions Trainline as a compelling long-term play on Europe’s shifting rail landscape.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#Trainline #shares #steam #ahead #ticket #sales #lifted #French #rail #competition #shakeup