Advertisement

The US Federal Reserve is set to push ahead with interest rate cuts next week despite higher than expected consumer price inflation in August. Economists said President Donald Trump’s trade tariffs had finally begun to emerge in the latest CPI report, which showed core inflation flat on the previous month at 3.1 per cent on an annualised basis.

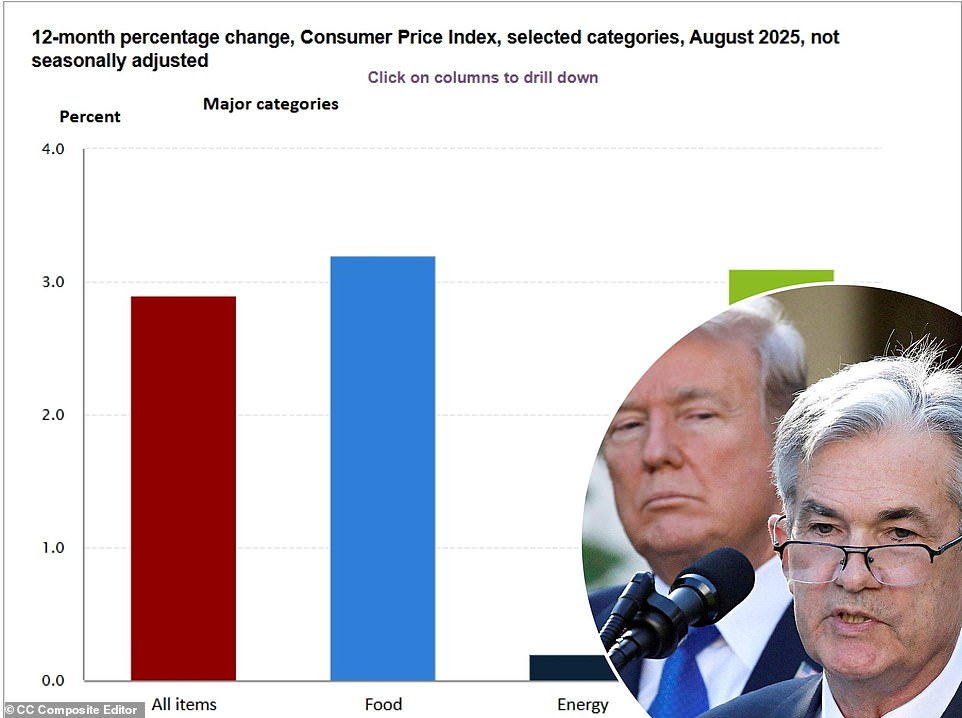

The consumer price index was up 0.4 per cent for August, ahead of forecasts of 0.3 per cent and after advancing 0.2 per cent in July. It was up 2.9 per cent year-on-year, up from 2.7 per cent in July.

Stephen Stanley, chief economist at Santander US Capital Markets, said: ‘The evidence is overwhelming that more tariff-related inflation is coming, though it may still be several months before it passes through fully.’

Atakan Bakiskan, US Economist at Berenberg, added: ‘President Donald Trump’s inflationary policies – tariffs and restrictive immigration measures – are gradually showing up in the hard data and continue to erode consumers’ purchasing power.’

It came as the European Central Bank opted to keep eurozone interest rates on hold on Thursday and ahead of the Bank of England’s monetary policy committee meeting next week, which is also expected to see base rate held at 4 per cent.

Fed rate cut looms next week

Higher than expected inflation has not dented market expectations for a Fed rate cut on 17 September. Inflation data coincided with official figures on initial jobless claims, which will drive concerns about signs of economic stagnation.

The figures showed first-time applications for unemployment benefits jumping to 263,000 in the week of 6 September, up from 237,000 the week prior – the fastest pace of increase since October 2024 and the highest level since October 2021. Chris Beauchamp, chief market analyst at IG, said: ‘Quite how hot a CPI we would have needed today to deter a Fed move next week is now an academic question.

‘The data is clear, a weakening picture in employment means the Fed has to push on with easing even with inflation fears still lurking. ‘Perhaps Powell will be privately glad that he has such cover, since it helps allay concerns that the Fed has buckled under White House pressure.’

However, suggestions that Fed chair Jerome Powell could opt for a bumper rate cut of 50 basis points at its next meeting came under pressure following the latest inflation data. Seema Shah, chief global strategist at Principal Asset Management, said: ‘An emergency sized rate reduction is not required.

‘Jobless claims have jumped but are still quite low compared to 2021 levels, while the broader economic activity data and earnings reports do not signal an economy that is approaching a recessionary tipping point.’ Markets are now fully pricing in three Fed rate cuts of 25bps each this year.

It means the Fed’s key interest rate range will fall from its current level of 4.25 to 4.5 per cent to 4 to 4.25 per cent after its September this year. Forecasters think two more cuts will bring the rate range to 3.5 to 3.75 per cent by year-end.

#inflation #higher #expected #ahead #Fed #rate #decision