With Russia baiting Poland and the West, turmoil in the Middle East and growing unrest across the US, the world seems both dangerous and unpredictable.

It’s not great here either. Business leaders from former M&S boss Sir Stuart Rose to chemical billionaire Jim Ratcliffe are lining up to denounce the Government, warning that Sir Keir Starmer and Rachel Reeves are taking Britain to the brink of catastrophe.

Yet the FTSE 100 is flirting with record highs and other indices are rising too, prompting seasoned observers to worry about a disconnect between inexperienced, over-optimistic traders and reality.

At such times, caution and discrimination are critical, and certain shares stand out, having demonstrated resilience in the past and developed credible plans for growth in the future. Here are four worth looking at.

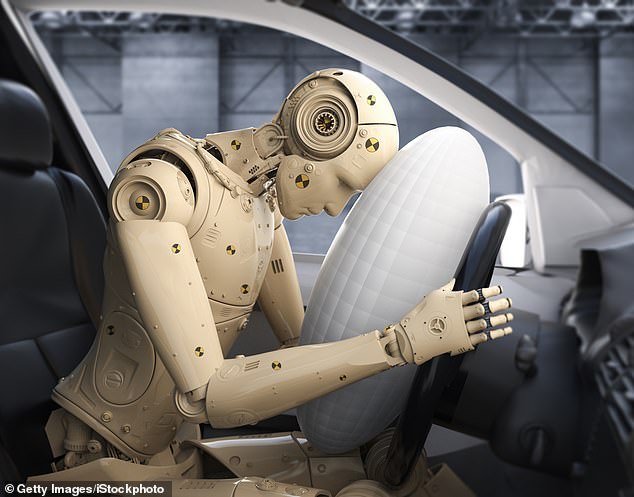

Crash-proof: Caution and discrimination are critical, and certain shares stand out, having demonstrated resilience in the past

Galliford Try

The construction industry has a reputation for over-promising, under-delivering and losing piles of money in the process.

Since spinning off its housebuilding arm in 2020, Galliford Try has made a point of sticking to the sectors it knows. That simple strategy has delivered robust gains in sales, profits and dividends.

Specialist areas include defence, from Armed Forces accommodation to top-secret sites for defence operations. The group also builds and upgrades schools, prisons and roads and is a key supplier to the water industry as it improves infrastructure after decades of under-investment.

Results for the year to last June will be released this week and are expected to show a 7 per cent increase in sales to £1.9 billion, a 30 per cent surge in profits to £42.5 million and a 15 per cent hike in the dividend to 17.8p. Further strong growth is forecast, with chief executive Bill Hocking targeting revenues of more than £2.2 billion by 2030.

Galliford has more than £4 billion of orders on its books, with 90 per cent of current year revenues already secured and some customers talking about projects ten years ahead.

That inspires confidence, and Galliford shares have done well. At £4.17 there is still plenty of potential, and some brokers believe it may hit £5.40 in the coming months.

Traded on: main market Ticker: GFRD Contact: gallifordtry.co.uk

Volution

Vent-Axia owner Volution joined the stock market in 2014, since when it has delivered annual growth of more than 10 per cent and increased dividend payments every year bar Covid-blighted 2020.

Specialising in ventilation, the firm’s success reflects a growing recognition that indoor air quality is crucial for health. Efficient ventilation is mandatory in new homes and Volution is a leader in the field, not just in the UK but also in Australia and New Zealand, with a growing share in Europe too.

Chief executive Ronnie George has been at the helm for nearly 14 years, driving growth both organically and through a steady stream of acquisitions. The shares have responded, soaring fourfold to £6.30 since Midas first recommended them in 2014, with plenty of attractive dividends to boot.

There should be more to come. The Government’s commitment

to build 1.5 million new homes by 2029 is way behind target but even if new Housing Minister Steve Reed achieves half that figure, Volution will be a strong beneficiary. And many other countries, from Australia to Sweden, are grappling with a shortage of homes and are determined to increase the pace of housebuilding, to Volution’s advantage.

City analysts predict a near-20 per cent increase in profits to £93 million when annual figures are reported next month, rising steadily next year and in 2027.

With dividends forecast to move ahead too, Volution shares should continue to deliver.

Traded on: main market Ticker: FAN Contact: volutiongroupplc.com

XPS

Pensions specialist XPS has an enviable track record too, increasing sales, profits and dividends for years, with plenty more growth in the pipeline.

It works with around 1,300 businesses, ranging from John Lewis to IBM, looking after the pensions of more than a million existing and former employees. Boss Paul Cuff, an actuary by training, has been at the helm since 2016, delivering growth throughout. This resilience should persist. Businesses stick with the group for years, such that 90 per cent of annual sales are recurring.

In recent times, many more companies have started to offload pension schemes to insurers, and this is another rich seam for XPS.

Brokers predict steady growth matched by rising dividends, with 12.5p pencilled in for 2026, climbing to 13.8p the year after.

XPS shares are a long-term, defensive buy.

Traded on: main market Ticker: XPS Contact: xpsgroup.com

DCC

DCC sells oil and gas to off-grid business and residential customers, from major industrial groups to rural farmers.

The Dublin-based business has increased payouts to shareholders every year since floating on the stock market in 1994.

Operating in the UK, Europe and the US, its long-term relationships with customers created steady revenue and profits growth.

Buoyed by its success, DCC then branched into healthcare and technology – a misguided decision that saw shares fall from nearly £80 in 2018 to £47.30 today. However, they are ripe for recovery.

The healthcare division has been sold and £800 million is being returned to shareholders, as DCC buys back stock from investors. Part of the technology division has also been sold and the rest is likely to follow suit, delivering more rewards for investors and sending DCC shares firmly upwards.

Traded on: main market Ticker: DCC Contact: dcc.ie

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#MIDAS #SHARE #TIPS #crashproof #stocks #survive #economic #disaster