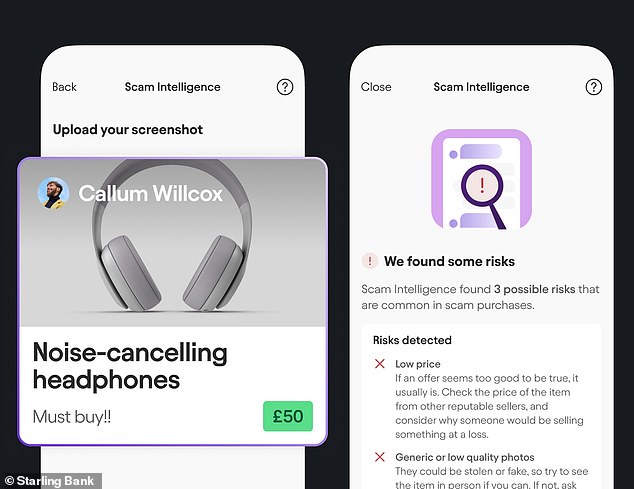

- Customers can upload suspicious online listings and get a second opinion

A British bank has launched an AI tool in its app in a bid to stop customers falling victim to scams on online marketplaces.

The Scam Intelligence tool allows Starling Bank customers to upload images of items, adverts and messages they have seen on online selling platforms such as Ebay, Facebook Marketplace and Vinted.

Starling then uses AI to analyse the adverts for signs of fraud and gives guidance to the user on how they should act.

For example, the AI tool may warn users that an advert is offering a price that is too good to be true, the image used isn’t genuine or the bank details don’t match the seller’s details.

The tool can also analyse texts and other messages from potential scammers asking for money transfers.

Starling says fraud cost the UK £1.17billion in 2024, with authorised push payment fraud accounting for as much as £450million of this.

Authorised push payment fraud is when a fraudster persuades the victim to transfer them money under false pretences – for example, pretending they have a product to sell and then never sending it.

Sniffing out scams: The tool, which can be found on the payments tab of the Starling Bank app, is available to personal, joint and business account customers

Under rules put in place in October 2024, banks should generally reimburse victims of this type of scam unless the customer has shown gross negligence.

Recent figures from Experian revealed that more than a third of people, some 37 per cent, said they have experienced scams on online marketplace websites and apps.

Almost a quarter of victims lost between £51 and £10 in each case, while 13 per cent lost of £250 and four per cent of victims lost between £501 and £1,000.

The most common type of scam involved buyers receiving fake or counterfeit products, Experian said. This wouldn’t be covered by the APP fraud rules, but customers could lodge a chargeback with their debit or credit card provider.

Starling says the tool will help customers to avoid APP fraud by warning them against scam indicators and educating them on what to look out for in future.

Harriet Rees, chief information officer at Starling Bank, said: ‘With Scam Intelligence, Starling customers can better protect themselves from scams, and learn more about the warning signs too.

‘Knowledge is power when it comes to managing and protecting your money, and we believe AI is giving our customers exactly that.’

The tool, which can be found on the payments tab of the Starling Bank app, is available to personal, joint and business account customers.

Customers need to opt in to use the technology, which uses Google’s Gemini models on the Google cloud platform.

Lord David Hanson, minister for fraud and Labour peer, said: ‘Fraud is ruthless, and it’s vital that every organisation supports people to avoid scams. I welcome Starling’s new tool, which is a great example of how AI can be used in the battle against fraud.’

Starling says this is the first time a UK bank has offered AI scam detection tools built into its app, and comes after Starling launched its Spending Intelligence tool earlier this year, which helps customers to understand their spending habits using AI.

Earlier this year, Metro Bank partnered with Whatsapp-based scam checking tool Ask Silver to offer customers a ‘second opinion’ on potential scams.

There are plans to integrate Ask Silver into the Metro Bank App, with the aim being that Metro Bank customers can check and report scams without leaving the banking app.

Ask Silver also said that the scam checker is in the process of onboarding other banks to use its tool.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#detective #stop #people #falling #online #selling #scams