Carbon emissions from homes with high ‘EPC ratings’ have been proven to be little different from poorly insultated properties, a new study has found.

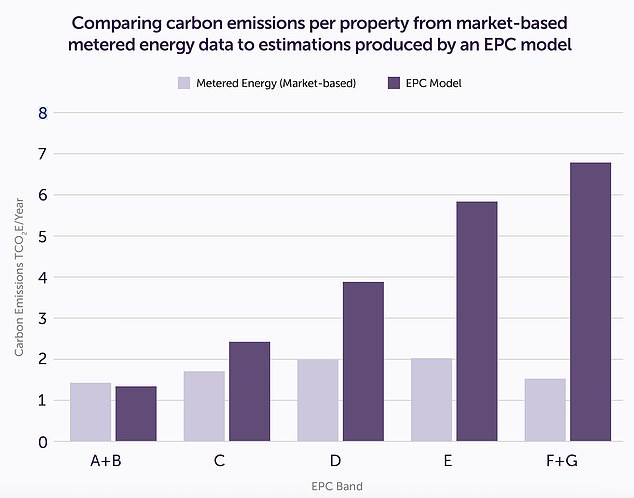

The study compared estimates of CO2 emissions from 1,038 homes based on their Energy Performance Certificate rating with measurements derived from actual meter readings from these same homes.

The meter readings in the study showed minimal variations in emissions between properties of very different EPC ratings.

All homes now require an Energy Performance Certificate (EPC) in order to be sold or let.

The EPC is a rating scheme which bands properties between A and G, with an A rating being the most energy efficient and G the least efficient.

Having a lower EPC rating of A, B or C can give households access to cheaper mortgages and may even increase house prices for prospective buyers who may be led to believe they are buying a property that will keep their enegy bills low.

The study showed that actual carbon emissions from properties in EPC bands A-C, regarded as the most energy efficient, are not significantly lower than for properties in EPC bands D-G

Landlords also need to ensure their properties have a minimum EPC rating of E in order to let them, unless they have an exemption.

The Government is considering upping this requiremnt for landlords to a C rating, which could impact both private rentals and holiday lets by 2030.

The study, which was led by Atom Bank, brings into question the usefulness of EPCs and will raise concerns that Britain’s eco regulations are being based on bogus assessments.

The study showed that actual carbon emissions from properties in EPC bands A-C, regarded as the most energy efficient, are not significantly lower than for properties in EPC bands D-G.

Initially, Atom Bank assumed this may be due to personal choices by the households being monitored.

However, experts at University College London’s (UCL) Energy Institute observed a similar pattern across a larger national dataset – finding little variation in primary energy use above EPC band C, even after accounting for factors such as family size and thermostat temperature.

The UCL team has subsequently been working to identify causes of discrepancies as part of a government study into EPC accuracy, but this has not yet been published.

EPCs are not fit for purpose

Gareth Jones, a solar expert and president of the Federation of Master Builders in Wales says EPC assessments have not kept up with the times. He is also concerned about the rise of rogue actors appearing across the sector.

‘EPCs are not fit for purpose and have not kept up with modern technology and changes across the sector,’ says Jones.

‘There is a massive problem with rogue assessors drawing up bogus EPC reports and getting away with it.

‘It’s in the interest of some of these rogue EPC assessors to give a bad rating so that they can then get referrals from households or landlords having to follow their suggestions in order to upgrade their homes.

Jones adds: ‘Many of these assessors don’t know if there is insulation in the walls, under the flooring or in the loft. A lot of their reports are just based on assumptions.’

‘Building practices are constantly improving and there is a lot more thermal technology around now. Equipment and fittings are different. Houses are different. But EPC assessments are little different from what they were 20-odd years ago.’

More needs to be done to combat the rouge assessors, according to Jones.

‘There is significant government funding going towards energy upgrades and this is being exploited by rogue EPC assessments,’ he says.

‘The whole system is not fit for purpose. If someone is a rogue assessor there needs to be tougher penalties placed on them if EPCs are found to be incorrect.

‘EPCs currently have massive implications on mortgages and the ability to let a property. People can find themselves paying tens of thousnads of pounds based on an EPC assessment that is simply wrong.’

Gareth Jones, a solar expert and president of the Federation of Master Builders in Wales is worried about rouge EPC assessors

EPC reform needed

Atom Bank is calling on the energy suppliers, the Government and the financial services industry to collaborate on EPC reform and to improve the accuracy of housing-related carbon data.

Atom is also calling on the Government to accelerate proposed EPC reforms, including shifting from estimated to actual energy performance data, such as from utility bills or smart meters.

They also want to see a more accurate EPCs and more rigorous assessments of build quality to ensure homes meet their energy performance claims.

The EPC is a rating scheme which bands properties between A and G, with an A rating being the most energy efficient and G the least efficient

‘The UK has made real progress in addressing the challenge of decarbonising its economy but continuing that momentum will require better data and more targeted action,’ said Edward Twiddy, director of ESG at Atom.

‘This study reveals that EPC ratings do not reliably reflect actual household emissions, with inaccurate data being a clear hindrance to reaching net zero.

‘If most households are using similar amounts of energy, the focus should be on where that energy comes from and then how to make that clean energy as affordable as possible.

‘The findings of this trial have important implications for green lending, banks’ carbon reporting, and the future use of EPCs in measuring and reducing residential emissions, which has implications for social issues like fuel poverty.’

Scott Harrison, director of strategy & innovation, business information at Experian, added: ‘Collaborating with Atom on this study has reinforced what we at Experian have long understood – EPCs are not a sufficiently accurate way of measuring household carbon emissions.

‘This trial highlights the urgent need to shift from theoretical estimates to real-world data.’

#EPCs #fit #purpose #industry #insider #warning #bogus #surveys