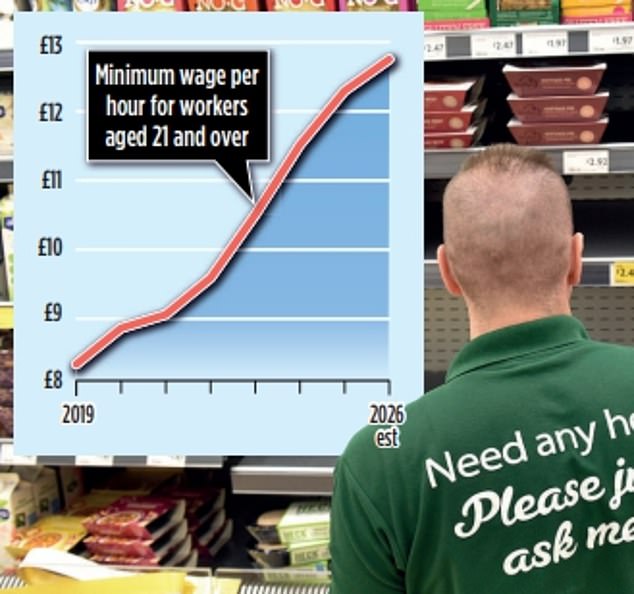

Another inflation-busting rise in the minimum wage is set to be recommended in a further blow to firms already reeling from higher employment costs.

The minimum wage, also known as the national living wage, currently pays £12.21 an hour to workers aged 21 or over.

But the Low Pay Commission, which sets the rate, will advise the Chancellor this week that it should increase to about £12.71 from April next year – a 4.1 per cent rise.

That is higher than inflation, as measured by the Consumer Prices Index, which is running at 3.8 per cent, but is expected to fall next year as food and energy price increases ease.

The independent body will also recommend whether the £12.71 an hour rate should be extended to those aged 18 to 20, for whom the rate is currently £10 an hour.

About 1.9 million workers are currently paid at or below the £12.21 rate, with 16- and 17-year-olds over school leaving age and apprentices paid a minimum of £7.55 an hour.

Stacking up: Shops say the rate has risen 27 per cent in three years

However, if the age limit were lowered it would inflict even more pain on companies after they were hit with a £25 billion hike in employers’ National Insurance Contributions in last year’s Budget. Business rates are also set to increase for thousands of firms.

‘Shop owners want to see a cautious approach,’ said Andrew Goodacre, chief executive of the British Independent Retailers Association trade body.

‘They want to pay their staff fairly but the national living wage has increased by 27 per cent over the past three years – way ahead of inflation,’ he added.

‘Most independent retailers would like to see next year’s increase pegged back to inflation, which is forecast to be falling by next April,’ said Goodacre, who also sits on the Low Pay Commission board. He declined to comment on what its latest recommendation would be.

The Commission is tasked with ensuring that the minimum wage does not fall below two-thirds of average earnings. It has previously projected a range for the new minimum wage of between £12.55 and £12.86 an hour.

Separately, almost half a million workers are in line for a big pay boost after they were awarded a 6.7 per cent rise in the ‘real living wage’. This is a rate adopted voluntarily by 16,000 companies and it will go up to £13.45 an hour, or £14.40 an hour in London.

Living wage employers, who include Nationwide Building Society, accountancy firm KPMG and insurer Aviva, have until May next year to bring in the rise, which is based on the cost of essentials.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#Firms #sound #alarm #face #wage #bill #bombshell