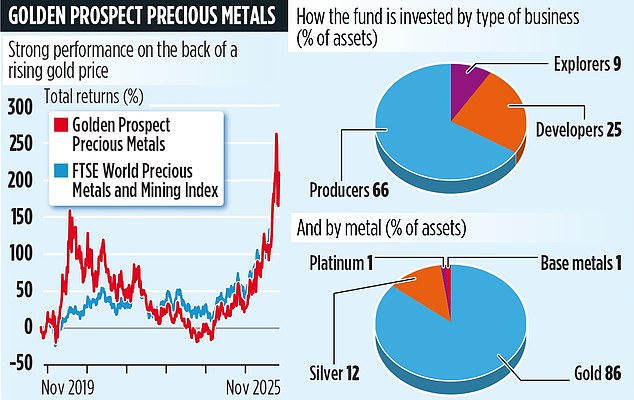

Investors in Golden Prospect Precious Metals have enjoyed a terrific year so far, seeing the value of their shares rise by more than 140 per cent.

But the investment managers running the fund are convinced there are more gains to come on the back of a resilient gold price.

The investment trust, listed on the London Stock Exchange, is managed by Keith Watson and Robert Crayfourd who between them have more than half a century of experience investing in mining stocks.

They are part of a three-man investment team at New City Investment Managers, who between them look after four trusts with assets of around £600 million.

Three of the four – CQS Natural Resources, Geiger Counter and Golden Prospect – have a mining stock focus.

‘We’re fund managers and analysts wrapped into one,’ says Crayfourd. ‘We meet hundreds of companies every year and attend key mining conferences – all in a quest to deliver stellar returns for our shareholders.’

As its name implies, Golden Prospect is primarily focused on identifying listed companies involved in the mining of gold whose shares have the potential to outperform the gold price. It’s an investment objective which results in a 60-strong portfolio of global stocks with holdings in both Canadian and Australian gold mining companies.

With gold currently trading at around £3,060 a troy ounce – 48 per cent up on a year ago – Crayfourd says the price may now take a pause. But he believes it will advance again next year to £3,500 – maybe higher. He says sustained buying by the world’s largest central banks (most notably China) will drive the price forward.

For gold stocks, the manager believes the outlook is even rosier.

He says: ‘If you look at the earnings and valuations of most gold mining companies, they are as attractive as they have been for many years.

‘Typically, their shares underperformed the gold price in 2022 and 2023, then tracked it for a while, but this year they have outperformed and there is more catch up to come.’

Although the fund holds some mining stock giants such as Canadian based Equinox Gold (capitalised at £6.5 billion), its focus is on searching for smaller gold companies which have gone under the radar of rival managers and analysts – and offer the potential for superior returns.

‘We hold Equinox because it took over Calibre earlier this year, a Canadian company we invested in six years ago,’ explains Crayfourd. ‘We’ve kept our stake because the chief executive of the combined company is Darren Hall who was the previous boss of Calibre.

‘We backed him and his management team at Calibre and he didn’t let us down. We see no reason why he can’t do a similar great job at Equinox.’ The trust has made a 750 per cent return on its initial stake in Calibre, bought in October 2019.

Smaller companies that have come good include Canadian listed TDG Gold, which has generated to date a return of 420 per cent on a position taken in October 2023. Despite the trust’s good investment form, it remains a minnow with assets just shy of £100 million. A current rights issue, providing shareholders with the opportunity to buy one share at a discounted price for every five they hold, could bring a small amount of new assets under its wing.

Total annual charges of 2.2 per cent are expensive, although Crayfourd says these should be looked at in the context of the returns generated for shareholders.

The trust’s market ticker is GPM and the identification code B1G9T99.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#GOLDEN #PROSPECT #PRECIOUS #METALS #Investors #sitting #gold