Investors are treating the astonishing rebound since markets threw a tantrum over Donald Trump’s tariffs with caution.

While many are celebrating a major boost to their portfolios – with the S&P 500 up 35 per cent from its April low – there are concerns over the valuations of US tech giants and the stability of the AI boom.

So, how can you find the best companies in the world to invest in but dodge the hype?

On this episode of the Investing Show, Simon Lambert is joined by Chris Rossbach, manager of the J Stern and Co. World Stars Global Equity fund, who explains how it looks for the world’s highest quality companies at valuations that work.

‘You have to pay up for quality’, says Rossbach, but he adds a vital caveat: ‘Overpaying for something is never going to work and never has.’

Nvidia is now the largest of all the US tech giants, with its $4.5trillion market capitalisation.

But while Rossbach says ‘there are some very large, overvalued companies out there’, Nvidia is not one he is worried about.

The AI computing chipmaking goliath is the largest position in the fund and one that Rossbach holds up as an example of the quality companies it seeks.

The manager believes Nvidia will continue to benefit from the huge investment into data centres and computing infrastructure, is generating huge amounts of cash, and has a very significant opportunity.

He says: ‘We’re in an environment where markets are more fully priced and where there are some very large, overvalued companies out there.

‘We think Nvidia, the largest company now in the world, is not one of those. It’s an incredible business, because computing capacity is only at the very beginning.’

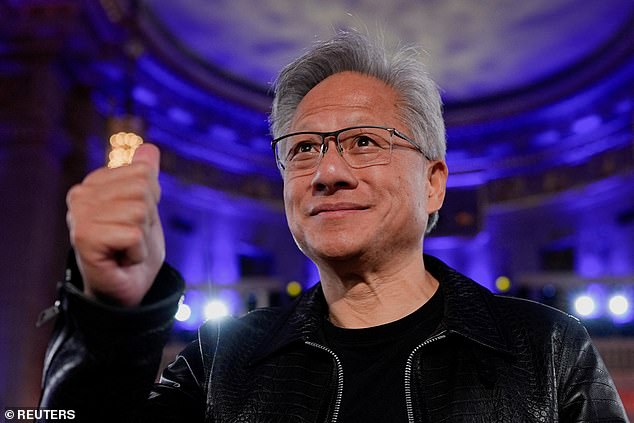

Nvidia, led by CEO Jensen Huang, has become the world’s largest company off the AI boom

Rossbach explains the fund’s formula for working out what makes a company count as one of the best in the world and how it looks for quality.

And he highlights some companies that are away from the limelight and offer investors the chance to back great opportunities that others are ignoring.

These range from a US power management leader, to some consumer and luxury household names, and the global eyecare and eyewear specialist that has bought streetwear brand Supreme.

The fund has ongoing charges of 1.12 per cent and holds a concentrated portfolio of 20 to 30 stocks. As its portfolio differs substantially from the market, its short-term performance has slipped behind global indices where returns have been driven by a small number of large companies. Over three to five years, the fund’s performance has comfortably outstripped the market.

J Stern and Co. World Stars Global Equity fund is up 6.4 per cent over one year, 47.3 per cent over three years and 57.1 per cent over five years. Over a similar period, the MSCI World Index is up 17.7 per cent over one year, 24.3 per cent over three years and 14.9 per cent over five years.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#invest #worlds #companies.. #arent #Nvidia #INVESTING #SHOW