Britain ranks high as a place to spend retirement despite financial indicators worsening slightly over the past year, a new study shows.

It is second only to Germany among the largest developed countries in the world, though just 14th when less populous but wealthy European nations are in the running too.

The greatest improvement was seen in health, especially life expectancy, which helped the UK jump from 18th to 10th place as it recovers from the pandemic.

But financial markers like income inequality and unemployment slipped compared with a year ago, according to the annual Global Retirement Index compiled by asset manager Natixis.

This analyses the 44 largest and most advanced countries in the world to see where people are likely to enjoy the most healthy and secure old age.

This year, Norway took the top spot, knocking Switzerland down to third place. Ireland came second, and Iceland and Denmark round out the top five.

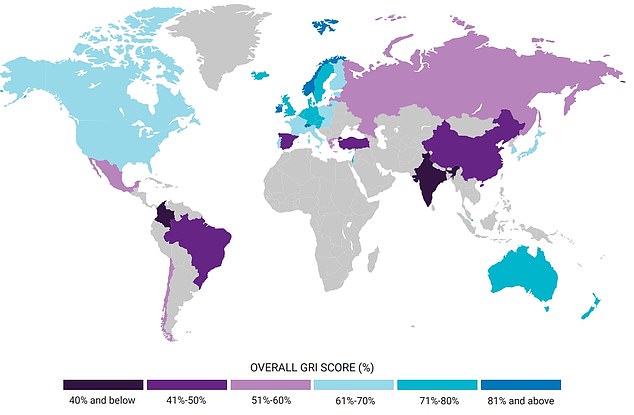

Global Retirement Index: UK scored 72 per cent across health, quality of life, material wellbeing and finances in retirement

The UK made a much better showing among larger countries, which have more complicated economies. It moved up from third to second place, and beat Canada, the US, Korea, Japan and France.

It is easier to achieve consensus and make faster improvements in smaller countries, according to Natixis, which for example notes the strong economic recovery in places like Ireland and Iceland since the financial crash in 2008.

The firm assessed and scored countries in four main areas – health, quality of life, material wellbeing and finances in retirement.

The UK was 11th for quality of life for the third year in a row, and remained in top place for clean water and sanitation, though it slipped a bit for air quality.

When it comes to happiness, the UK fell from 18th to 21st place this year, in line with its close European peers France and Germany.

Natixis also surveyed people across the world on their fears about retirement, and found they were most exercised about not having enough money to enjoy old age.

Inflation, cuts to benefits – like the state pension in the UK – never saving enough to retire and going broke from care costs were other top concerns.

Andrew Benton, head of Northern Europe at Natixis Investment Managers, says: ‘Pressures on retirement across the globe are undeniable.

‘In the UK, while rankings remain largely consistent, there are clear vulnerabilities in the labour market weighing on progress.

‘The Government has already signalled action, with reforms announced in July to strengthen pension systems, expand choice, and enhance consumer protections, and we expect to see more measures in the autumn Budget.’

Benton adds that the index reflects growing concern that achieving retirement security is getting harder, with volatility in personal finances, demographics, economics, and policy fuelling uncertainty.

SIPPS: INVEST TO BUILD YOUR PENSION

AJ Bell

AJ Bell

0.25% account fee. Full range of investments

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing, 40% off account fees

Interactive Investor

Interactive Investor

From £5.99 per month, £100 of free trades

InvestEngine

InvestEngine

Fee-free ETF investing, £100 welcome bonus

Prosper

Prosper

No account fee and 30 ETF fees refunded

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best Sipp for you: Our full reviews

#Britain #good #place #retire #Big #rich #countries #ranked