Investment fund managers Clive Beagles and James Lowen are flag wavers for the UK stock market – and they’ve been waving for the past quarter of the century, first at Newton and now at JO Hambro.

Despite the stream of listed companies leaving the market, either being bought or going private, and the undervaluation of the UK stock market compared to overseas rivals, they continue to find ways to make money for investors.

Since late 2004, they have jointly run fund JOHCM UK Equity Income: JOHCM standing for JO Hambro Capital Management, an investment house which oversees assets of £18 billion.

The £1.8 billion fund, providing investors with a mix of long-term capital and income growth, has been an outstanding success. Over its near 21-year life, it has delivered annual dividend growth averaging 9 per cent, with the only hiccups being in 2008 and 2020 when many UK companies were impacted by the global financial crisis and lockdown, respectively.

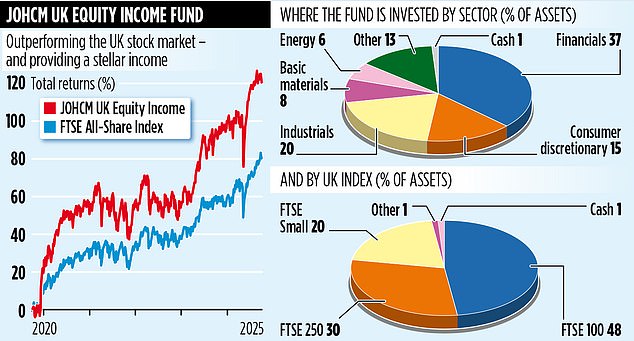

In terms of overall returns, it has outperformed both the FTSE All-Share Index and the average UK equity income fund over the past five years, registering a return of 117.4 per cent. The respective gains made by the index and the UK equity income sector are 82.8 and 70.7 per cent. Over the last year, the fund has achieved an attractive return of 14.5 per cent.

‘There are lots of ways to make money from UK equities,’ says Beagles. ‘Our forte is spotting companies whose shares have above average dividend yields and where we think businesses have the ability to grow their dividends. It often means fishing in a pond comprising companies whose shares are currently out of favour.’

The fund’s dividend yield of 4.6 per cent compares with a 3.4 per cent yield on the FTSE All-Share.

This approach means the managers trawl the length and breadth of the UK market in search of suitable stocks. The resulting 60-stock fund portfolio comprises a number of FTSE 100 dividend friendly stocks such as Barclays, BP, and Lloyds.

It also includes less familiar names such as FTSE 250 listed brick manufacturer Ibstock and FTSE All-Share stock Norcros, owner of numerous kitchen and bathroom brands (the likes of Triton and Merlyn).

‘Norcros is an excellent business,’ says Beagles. ‘It is a market leader, pays decent dividends and offers shareholders an attractive income [dividend yield] just short of 4 per cent.

‘But with a market capitalisation of less than £250 million, it’s too small a stock to attract widespread attention from investors. As a result, its shares are undervalued. Sadly, there is a possibility that at some stage it will be bought by a rival or private equity, and not at full value.’

Beagles believes many of the companies in the fund – including Norcros – will see their fortunes improve if the domestic economy starts growing. Although he admits rising UK gilt yields are a cause for concern, he says there are some positive signs in the form of strong household balance sheets.

When people have the confidence to draw down on these savings and start spending, he says it should bode well for retailers such as Currys and DFS (both fund holdings).

‘Some see Currys as yesterday’s child,’ says Beagles. ‘But it has a thriving mobile phone division in iD Mobile – and as consumer confidence increases, it will benefit from people replacing big ticket items such as computers. The same goes for DFS.’

Annual fund charges total 0.79 per cent and both Beagles and Lowen are personal investors in the fund – putting their money where their mouths are.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#JOHCM #EQUITY #INCOME #FUND #waves #flag #UKs #cheap #dividend #stars