Kraft Heinz is being broken up a decade after Warren Buffett’s £47billion mega-merger failed to achieve the growth that was expected.

The packaged goods group, which owns Heinz ketchup and Philadelphia cream cheese, will become two companies in a bid to revive its waning fortunes.

Billionaire investor Buffett, whose investment firm Berkshire Hathaway owns a 27 per cent slice of the group, said he was ‘disappointed’ by the split.

Investors were unimpressed, sending shares down more than 7 per cent in New York yesterday.

The world’s fifth-largest food and drinks firm was born when Kraft and Heinz were brought together in a £47billion tie-up in 2015.

It was the brainchild of Buffett, who recently announced his retirement, and Brazilian private equity firm 3G Capital.

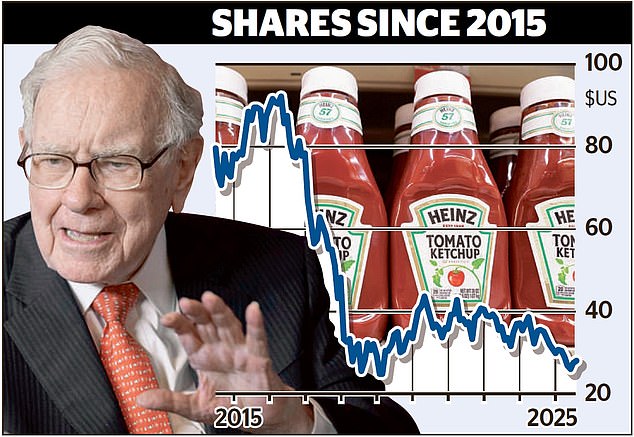

Dumped: Billionaire investor Warren Buffett (pictured)(, whose investment firm Berkshire Hathaway owns a 27% slice of Kraft Heinz, said he was ‘disappointed’ by the split

The idea was to capitalise on its huge scale. But changing tastes, as consumers switched to healthier options, complicated the company’s plans.

Despite changes designed to boost higher growth brands it has continued to struggle with sales falling 3 per cent last year.

The group’s share price has plunged by three quarters since a peak in 2017.

The company said in May that it was conducting a strategic review, signalling a potential split. It expects the transaction to close in the second half of 2026.

Executive chairman Miguel Patricio said yesterday: ‘Kraft Heinz’s brands are iconic and beloved, but the complexity of our current structure makes it challenging to allocate capital effectively, prioritize initiatives and drive scale in our most promising areas.’

The demerger is not simply a reversal of the original merger. One company, temporarily called the Taste Elevation Co, will focus on sauces and seasonings including Heinz, Philadelphia and Kraft Mac & Cheese.

And brands including Oscar Mayer, Kraft Singles and Lunchables will be organised into a US-focused firm, presently called North American Grocery Co.

The group said official names for the two businesses will be announced at a later date.

Alongside rivals including Unilever and Nestle, Kraft Heinz is facing challenges, including Donald Trump’s erratic trade policies and rising food inflation.

Reacting to the split, Buffett told broadcaster CNBC: ‘We will proceed to do whatever we think is in the interest of Berkshire.’

Greg Abel, who will take over from him at Berkshire Hathaway at the end of this year, has already written to Kraft Heinz to express his disappointment, Buffett said.

Russ Mould, investment director at broker AJ Bell, said: ‘Perhaps the wheels were always destined to come off this food juggernaut, but steering through recent price pressures and changing consumer habits have both taken an oversized toll on the business.’

Heinz began as a horseradish producer in Pittsburgh, Pennsylvania, founded by Henry J Heinz in 1869.

Kraft’s origins date back to the wholesale cheese delivery business founded by James L Kraft in Chicago, in 1903.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#Kraft #Heinz #splits #troubled #firms #bid #revive #fortunes #decade #merger #orchestrated #Warren #Buffett