Family-controlled firms tend to give off a whiff of the fuddy-duddy. When the same family has kept a reasonably tight grasp on their business through several generations, you might expect to see old-fashioned manufacturing practices, a lack of corporate oversight and perhaps an unwillingness to move with the times.

Research shows, though, that a family affair can be a profitable one. Until 2023, Credit Suisse ran a long-term study into the Family 1000 – a list of global quoted companies where families held 20 per cent or more of the shares. These businesses consistently outperformed their peers by 3 per cent.

Why might family-owned businesses outperform? Analysts often cite the fact that they’re focusing on building wealth for generations rather than the ‘next big thing’, while they can also be stable ports in a storm.

For investors, the trick is to find the family-backed businesses that remain forward thinking. Here are three to consider – the type of long-term buys you could pass on to your children.

Goodwin PLC

Run by the sixth generation of the Goodwin family, Goodwin PLC has been a Midas favourite for several years.

For a business that manufactures radars, it is certainly very good at flying under them. Most people would be hard pressed to say what the Stoke-on-Trent business actually does.

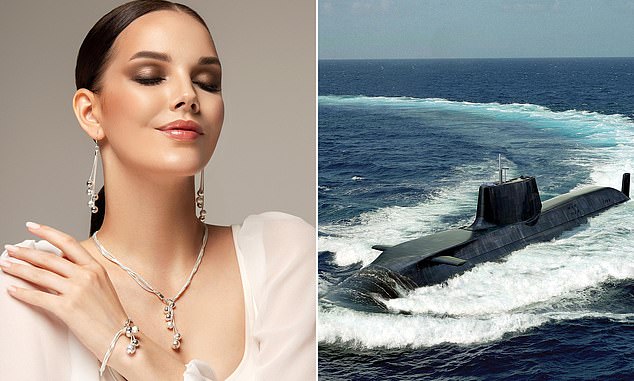

Legacy: Manufacturer Goodwin ranges from jewellery to submarine components

You’ll find Goodwin products in sectors as diverse as jewellery, where it provides moulds, and fire safety, where it has a product specifically to extinguish dangerous lithium battery fires.

Manufacturing in ten countries, it also has products squarely in the defence sector, including components for submarines, and makes air traffic control systems.

If you invest in Goodwin, you have to accept that the family calls the shots – they own more than half the shares. Furthermore, you’ll have no change out of £200 when you buy just one share. That means that investors who bought into this business when Midas last looked at it at £50.40 in 2023 have done exceptionally well.

But why should investors still buy in?

Firstly, because other companies find it hard to do what Goodwin does. The business has one of only five foundries worldwide that can cast components for frigates and submarines. Getting that accreditation took seven years, so no fly-by-night company is going to take the business.

Secondly, because the business is firing on all cylinders.

The latest trading statement, last week, stated that it would see double the trading profit before tax for this financial year compared with last, with a £365 million orderbook behind it.

The company is paying an extra dividend of 532p a share to those who are on the Shareholder Register on November 7.

The dividend will be paid out before any Budget announcements – the sort of foresight you might expect from a family-owned business with its own interests at heart. Buy.

Ticker GDWN Traded on: Main market Contact: goodwin.co.uk/investors

Caledonia Investment Trust

Feel like a shipping magnate by snapping up shares in Caledonia Investment Trust – the listed investment portfolio of the ultra-wealthy Cayzer family.

The descendants of Sir Charles Cayzer own half of the shares in the company, and any commoner can buy into the rest.

The investment team running the trust boasts that the family involvement allows them to think in ‘decades, not quarters’, and to buy and sell only when the time is right. The aim is to outperform inflation by 3 per cent over the medium and long term.

The investments inside Caledonia are diverse, with a third in public companies, just under a third in private capital and a similar percentage in global funds.

Long-term growth: The investment team running the Caledonia Investment Trust boasts that the family involvement allows them to think in ‘decades, not quarters’

By buying into Caledonia you take a bite of familiar names such as Microsoft, Philip Morris and AliBaba, but also a slice of the private company that provides tyre pump machines at petrol forecourts and wealth manager for the rich Stonehage Fleming.

Caledonia’s shares trade at a persistent discount to the net asset value, currently around 32 per cent. More recently though, the company has started to do something about narrowing that discount, buying back its own shares and initiating a share split to make it easier to buy and sell shares.

Narrowing the discount is something that should be in all shareholders’ interests. This is not an investment for the short term.

Ticker: CLDN Traded on: Main market Contact: caledonia.com/shareholder-centre

Associated British Foods

AB Foods is confusing enough before you even look at its family holding structure.

The company owns uneasy bedfellows Twinings and Primark, and adds in British Sugar and a Chinese animal feed business to complete the set.

Trusted brand: ABF owns brands such as Twinings

The multinational says that this breadth is one of its strengths. However, it doesn’t apply the same boast to its shareholder register, with over half of the shares held by holding company Wittington Investments, which is in turn owned by the Weston family and their charitable trust, the Garfield Weston Foundation.

AB Foods’ recent performance has been a mixed bag, with a trading statement in September guiding us towards the full-year figures coming up on November 4.

So why buy into ABF? Firstly, Primark remains an innovator and a strong presence in the clothing sector. And ABF’s diversified geographical footprint and business types mean that one area can often compensate for another.

The shares have had a good run – up 12 per cent this month and up 3.42 per cent since last year.

The shares, trading on 11 times their expected earnings, are cheaper than M&S and Next. There’s also a dividend yield of nearly 3 per cent.

Volatile times seem likely to continue for AB Foods, but in the long term it’s a business that has weathered many storms.

Ticker: ABF Traded on: Main market Contact: abf.co.uk/investors

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#MIDAS #SHARE #TIPS #Share #spoils #withfamilyrun #firms