Although the investment theme of technology is dominated by the ‘magnificent seven’ stocks in the US, some experts believe change is afoot.

Among them is Ben Rogoff, joint manager of the FTSE100 listed investment trust Polar Capital Technology. He believes artificial intelligence is changing the technology landscape, bringing new companies into the net from which he picks companies for the trust.

So, while the £5billion trust has key positions in all of the magnificent seven – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – they collectively represent a third of the portfolio. This is less than the 56 per cent they account for in the fund’s benchmark, the Dow Jones Global Technology Index.

‘The plan is to gradually reallocate away from the magnificent seven,’ says Rogoff. ‘The investment universe is in a state of flux and there are opportunities galore which we want to take advantage of on behalf of shareholders.’

He adds: ‘Our mission as the trust’s managers is to give investors of all shapes and sizes exposure to a broad church of companies and technology themes.

‘Some holdings will be racy, some will be unconventional, but the emphasis is on providing a portfolio that is carefully constructed, diversified, and gives investors exposure to technology in a carefully, risk-adjusted way.’

Rogoff’s comments come as a number of economists and investment experts fear that shares in some tech companies – especially the likes of chip maker Nvidia – have become overvalued and could be due a sharp correction.

Rogoff is an enthusiastic supporter (and personal user) of AI. But from an investment viewpoint, he is now interested in the companies which provide the hardware and power necessary for AI to function.

This results in the trust investing in companies that some would not classify as ‘technology’. For example, among the portfolio’s 93 stocks are businesses helping provide the energy to power massive AI data centres. They include US listed companies GE Vernova and Vertiv, German industrial giant Siemens and the UK’s Rolls-Royce.

Other are US business Corning and Swiss owned Belimo. Says Rogoff: ‘Corning is a company which was founded 170 years ago. We hold it because it manufactures the cables and fibre optics necessary for data centres to function. Belimo produces the valves that ensure data centres don’t overheat.’

The AI theme has also meant Rogoff disposing of some stocks. ‘We exited US software company Salesforce a year ago,’ he explains. ‘It’s a great company which we bought when it listed on the stock market more than 20 years ago. It’s done nothing wrong, but the software it provides for call centres to function satisfactorily is now being supplanted by AI.’

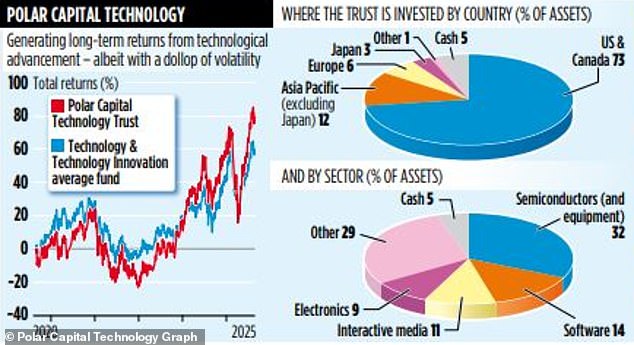

Polar Capital is a leading player in technology investing, running three funds with combined assets of £12.3billion. Apart from the investment trust, it manages funds Artificial Intelligence and Global Technology. The performance numbers are good. Over the past one, three and five years, Polar Capital Technology has delivered returns of 36.6, 96.1 and 85.3 per cent respectively, numbers better than the average for the technology and technology innovation sector over three and five years.

No one should buy this trust unless they are prepared to invest for the long term – and happy to accept the investment journey may be extremely volatile. Investing monthly is a sound strategy. Total annual charges are just under 0.8 per cent – and will tickle down as the trust’s assets grow. The stock market ticker is PCT and the identification code BR3YV26.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#POLAR #CAPITAL #TECHNOLOGY #moving #magnificent #tech #stocks