Turning water and air into fertiliser sounds like alchemy, but for ATOME it is almost within reach.

The AIM-quoted company is preparing for a final investment decision on its flagship Villeta project in Paraguay, and Canaccord Genuity reckons that, while there are challenges, the go-ahead looks credible.

Villeta is designed to produce 260,000 tonnes of calcium ammonium nitrate a year. That is a finished fertiliser product widely used across agriculture, combining nitrogen with calcium to boost crop growth while reducing soil acidification.

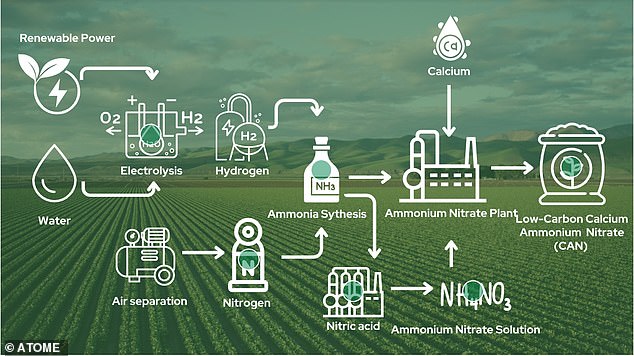

The twist here is that it is to be made using nothing more than electricity, river water, air and limestone, with almost zero carbon emissions.

The chemistry is straightforward. Water is split into hydrogen and oxygen, nitrogen is captured from the air, and the two gases are combined to make ammonia.

That ammonia is partly diverted to make nitric acid, which is then reacted with the remaining ammonia and ground limestone to create calcium ammonium nitrate. The contractor, Casale of Italy, has built such plants before, albeit not on this scale.

ATOME’s Villeta is designed to produce 260,000 tonnes of calcium ammonium nitrate a year

The cost is not trivial. Casale’s lump-sum contract comes in at $465million, with total project costs put at about $630million once commissioning and ancillary expenses are included. That equates to roughly $2,400 for each tonne of annual fertiliser capacity installed.

Canaccord estimates operating costs at about $140 a tonne, leaving plenty of headroom against local selling prices of $400 to $600. On that basis, project profitability could run at $260 to $460 per tonne, generating $10million to $50million of free cash flow to equity each year once debt service is covered.

To get there, the funding must be nailed down. ATOME has an offtake agreement in place with Yara, the Norwegian fertiliser group, which has agreed to buy all the output for ten years on terms that include a floor price and some sharing of any premium upside.

Hy24, a specialist hydrogen investor, has committed up to $115million of project equity, while ATOME is seeking another $100million from other backers.

Debt proposals are already oversubscribed, with indicative offers of $200million from the Inter-American Development Bank, another $200million from the Dutch development bank FMO, $135million from the European Investment Bank and $75million in concessional finance from global climate funds.

If those terms are finalised, ATOME is expected to retain about a fifth of Villeta’s equity once construction is complete. That may not sound much, but given the potential returns, Canaccord argues the stake will still be valuable.

More importantly, the analysts see Villeta as an industry first: a full-scale, grid-powered, zero-carbon fertiliser factory that could be copied elsewhere.

Atome itself is already looking beyond Paraguay. It has flagged projects in Costa Rica, Iceland and a second Paraguayan site at Yguazu, as well as a move into renewable power generation to secure cheap electricity for future ventures.

Shares in Atome have risen strongly on the back of each contract announcement, and Canaccord has raised its target price from 130p to 140p, keeping a speculative buy rating.

At 62p in the market, that still leaves plenty of theoretical upside, though the tag ‘speculative’ is well deserved. The company has no revenues yet and has been burning about $7million a year in overhead.

Final investment decision has been delayed before, and execution risk looms large once building starts.

A few cautionary notes: readers should always do their own due diligence. This kind of development is not without its risk and can be subject to unforeseen delays.

While Paraguay ranks among South America’s more stable economies, conflict in Ukraine and the Middle East and the Trump administration’s unpredictability show chaos can strike from anywhere, undermining valuations

Still, for those with the appetite, the investment case is easy enough to grasp.

If ATOME can turn cheap Paraguayan hydropower into premium-priced, low-carbon fertiliser, it may have found a way to make alchemy pay.

For all the market’s moving small- and mid-cap news go to www.proactiveinvestors.co.uk

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#Small #Cap #movers #Turning #water #air #zerocarbon #fertiliser